Not all brands are born equal in the face of tariffs

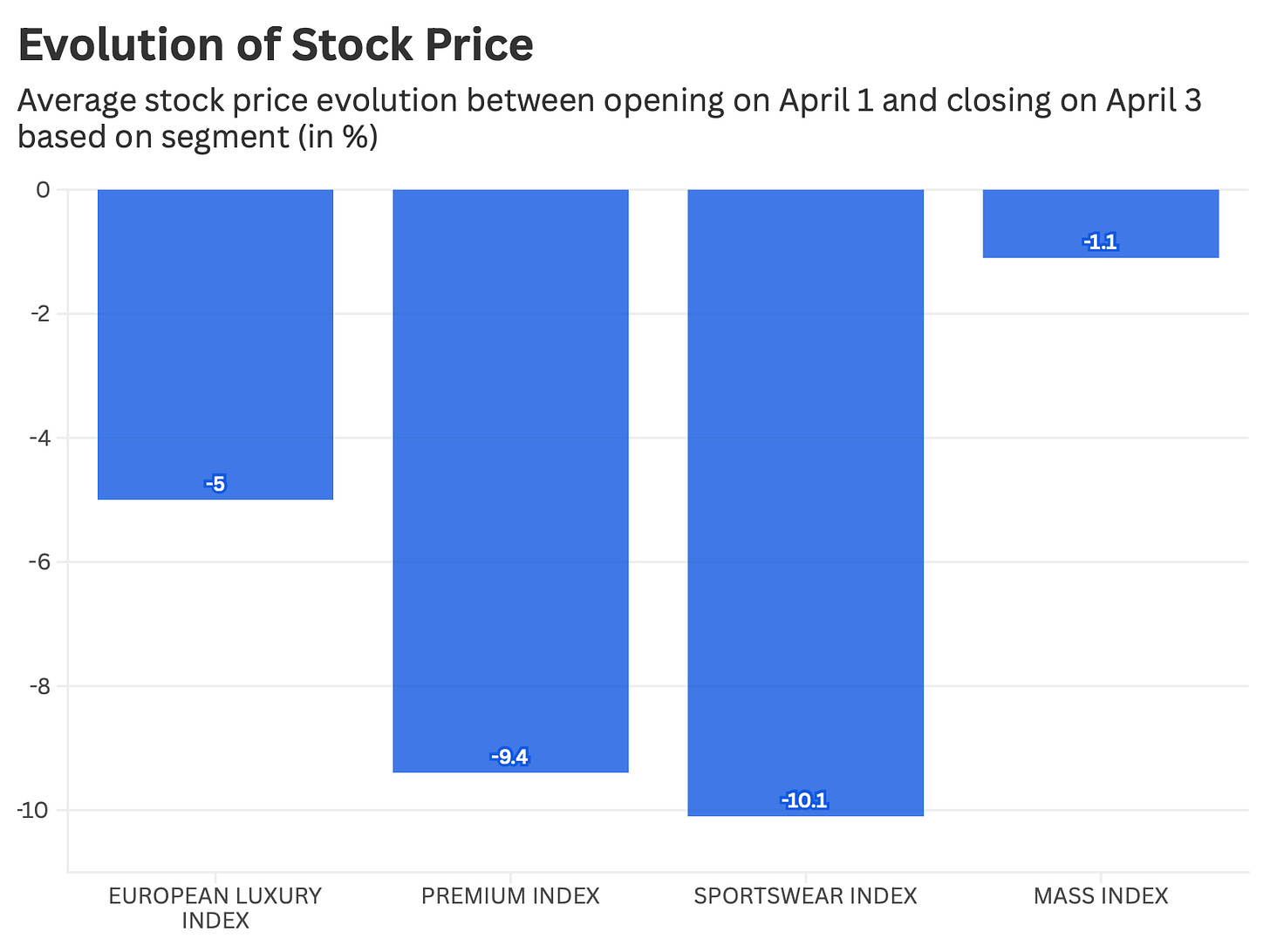

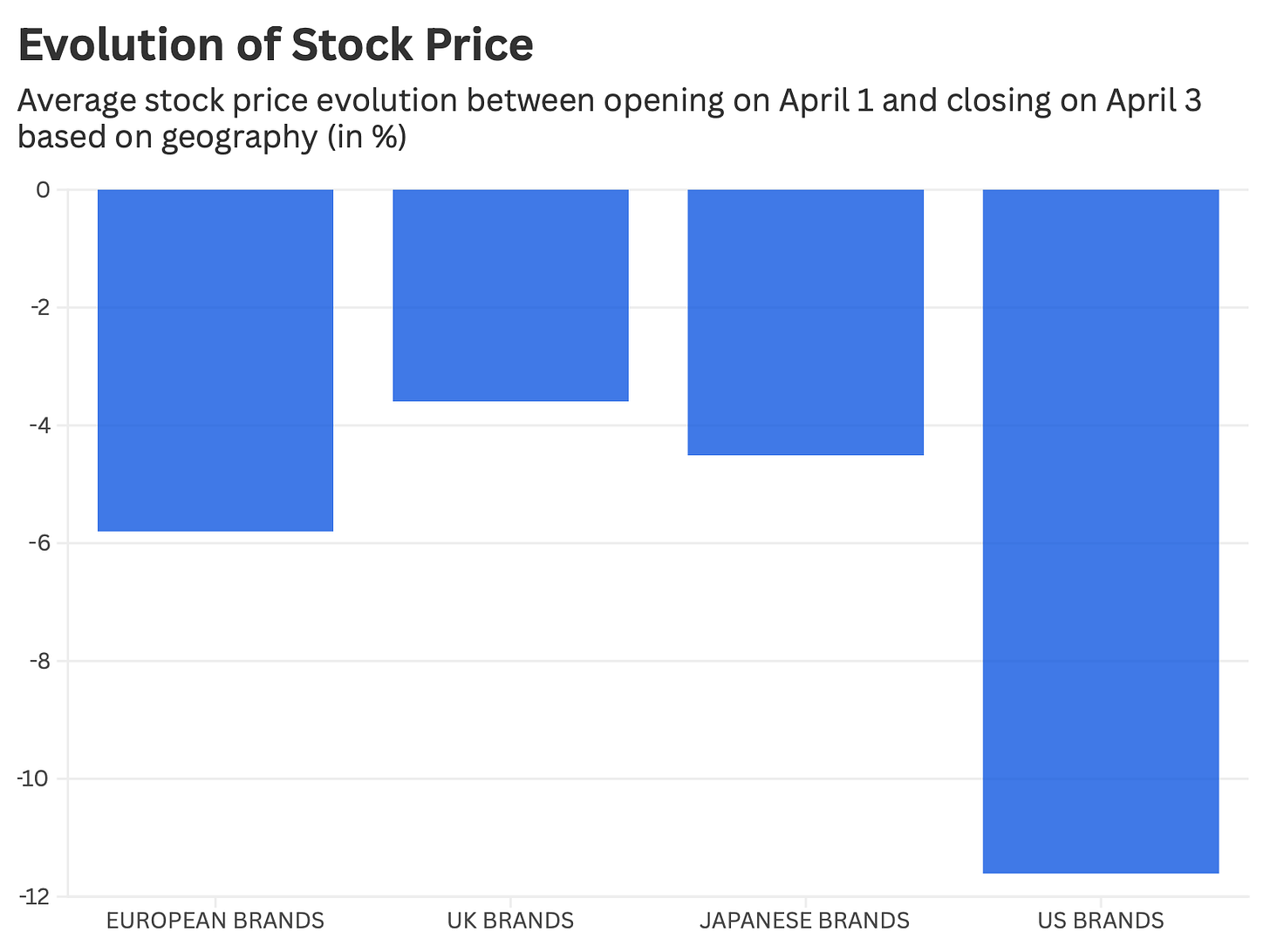

A look at the stocks' reactions on day one shows clear differences in impact appreciation across segments and geographies.

With all the noise around tariffs, I wanted to understand two things from the markets’ reaction yesterday:

How does a brand’s market segment1 - e.g. luxury, mass, premium, or sportswear - shape investors’ perceptions of its exposure to tariffs?

How does a brand’s country of registration influence how the potential impact of tariffs is assessed by investors?

Segment analysis

We see that on average each segment is impacted very differently. A few thoughts on the dynamics:

Luxury: having significantly raised their prices (on average) over the past few years, brands have limited room to redistribute the impact of tariffs entirely on their prices. However their robust (on average) profitability probably could make investors think that they can absorb some of those - which would explain why brands with profitability issues like Burberry or Kering had a worst day than others.

Mass: compared with the rest of the industry, mass market brands on average did not have a bad day. This is a little surprising but may be explained by the fact that their revenues are well balanced globally. For example Fast Retailing’s stock was up 1.14% between April 1st and 3rd, which may be explained by the fact that the US, although a growing market for the group, only accounts for 7% of its revenues.

Premium: largely reliant on countries that were hit with the highest potential tariff rates - incl. China, India, Bangladesh - and already in difficult market positions, premium brands got all quite severely hit yesterday, with Capri Holdings’ stock losing nearly 22% in two days.

Sportswear: the surprise high tariffs on Indonesia (32%), Cambodia (49%), and Vietnam (46%), which are countries where sportswear brands manufacture a significant proportion of their shoes, may explain in part the very negative reaction of the market for this segment.

Geographical Analysis

US based brands suffered the largest losses in the stock market yesterday. This may be explained by the combination of supply chains heavily reliant on China and south-east Asia, combined with a significant revenue dependance on the American market - for example 50% of Ralph Lauren’s revenues are in North America, a number that climbs to over 80% for American Eagle Outfitters.

Details on the analysis

The analysis was done over 8 luxury groups, 10 mass market groups, 7 premium groups, and 6 sportswear groups. The stock evolution was computed based on the opening price on April 1 and closing price on April 3. The average was weighted based on the market cap of individual companies at the end of 2024 to ensure representativeness of the indexed average.

The segmentation of luxury, mass, and premium is based on the preliminary outcomes of a project for Paris Good Fashion, supported by le Defi Mode, to support the creation of a segmented decarbonisation trajectory for the fashion industry - the results of which will be published later this summer.